The other week I referenced in passing the old schmaltzy tune ‘Love and Marriage’ as sung by Blue-eyes Sinatra back in the 1950s. It was the days of the old valve radio, with Aunt Daisy frenetically warbling away in the mornings.

There were lots of schmaltzy tunes back then. Silky-smooth crooners like Sinatra, Perry Como, Bing Crosby and Dean Martin were thick on the ground. And the play-lists were padded out with all manner of other candy-floss novelty discs like ‘How Much is that Doggy in the Window’.

But then one day another sort of tune started to get a bit of air play. A completely different type of tune. The voice wasn’t treacly smooth but gritty and tough. And the lyrics weren’t about mooning and swooning or surreys-with-the-fringe-on-top but about men sweating it out swinging picks deep in a dank and dangerous coal-mine, and struggling to get by on pittance wages.

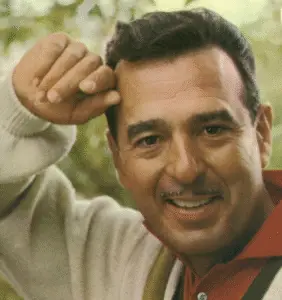

The singer was Tennessee Ernie Ford, the lyrics by Merle Travis, and the song was ‘Sixteen Tons’.

Some people say a man is made out of mud

A poor man’s made out of muscle and blood …

You load sixteen tons, what do you get?

Another day older and deeper in debt

Saint Peter don’t you call me, ’cause I can’t go

I owe my soul to the company store

The way Tennessee Ernie sung it you could smell and see the sweat glistening on the miners’ muscles in the dim light of their head lamps as they laboured in the subterranean caverns. The ‘sixteen tons’ referenced the daily quota of coal a miner was expected to dig.. and what did it get him? Another day older and deeper in debt!

The latter phrase struck a chord, and it has entered the language. I heard a radio announcer use it just the other day in some context or other. It’s retained its potency because for many people it still holds painfully true.

And you may recall Merle Travis’s other sobering lines in Sixteen Tons:

St Peter don’t you call me ’cause I can’t go

I owe my soul to the company store

The company store in days of yore was the work-site emporium where isolated workers were forced to buy their daily necessities at hugely inflated prices beyond the purchasing capacity of their weekly wages, and thus were trapped in perpetual debt.

Today the ‘company store’ spans the planet. It’s the financial sector at large, and the sector that’s been the most significant ‘growth area’ in recent times. Institutions that neither toil nor spin in terms of producing what might be called tangible consumable goods, but rather existing merely to massage, control and predate on the flow of profits created by society’s workers at large.

Debt has been around for a long time of course. The earliest discovered records of language such as the wedge-like cuneiform shapes inscribed on clay tablets used by the Sumerians five or so millennia ago refer to grain borrowed and grain owed.

It’s a handy facility to oil the wheels of trade and exchange, but always comes with its own set of obligations and challenges. We all know Dickens’ Mr Micawber’s famous remark: “Sixpence in debt – misery! Sixpence in credit – bliss!” Or words to that effect.

But the difference in this day and age is that the whole process has become industrialised. Debt been sliced, diced, spliced and commodified into hundreds of little baited hooks just waiting to snare the unwary and wary alike!

And what’s made the industrialisation of debt possible is the almost literal other side of the coin – the industrialisation of credit.

Once credit was freed from the moderating necessity to be asset or bullion-backed, and regulatory control of commercial bank largely surrendered, the world was suddenly awash in tsunamis of credit. And the corresponding debt is now about 340 trillion US dollars – an unimaginable amount of what’s now euphemistically known as ‘money’ that cannot now or ever be repaid. It’s all become a giant Ponzi scheme supported by the issuing of even more credit to support the interest payments required to service the mountainous debt already accrued. And why of course inflation is a ubiquitous and inevitable component of the whole system: the silent burglar that silently steals value 24/7 from savings and wage packets.

Ponzi schemes are, we are told, illegal. But not so it seems when it comes to our own Government-sanctioned monetary systems.

Thus, ‘credit’ has become the perfect commodity – requiring no satanic mills or factories, no assembly lines and indeed no messy infrastructure or troublesome employees whatsoever, other than those attached to the counting houses – the banks and various financial institutions required to keep track of the electronic numerals pulsing through the global networks recording the dizzying array of digital transactions.

Sovereign nations with their own Government-owned central bank – such as NZ, with its Reserve Bank – are thus ideally placed to create credit. Contrary to what various ministers of finance consistently parrot about there being “no money-tree”, there is indeed a money-tree. It’s the Reserve Bank. And a sovereign Reserve Ban can ‘print’ as much money as the Government of the day orders it to, which it has the power to do under certain circumstances.

But no sane government does this willy nilly because flooding the economy with cash would trigger rampant inflation, ultimately devaluing its own currency. So it’s a balancing act that has to keep money supply tethered to available labour and resources.

But it’s why sovereign governments can plead poverty one day and then suddenly pluck many billion dollars out of the hat the next. As was demonstrated with knobs on during Covid peak years.

So don’t buy into all the usual schtick about the need to “tighten our belt” or “balance the books” or any number of other common clichés. There’re times for such measures, but not at present. Usually it’s just shorthand for “we’d rather give tax-breaks to landlords than pay nurses (or whomever) a realistic wage”.

And because our Government-owned Reserve Bank is the only institution able to create ‘money’ and thus expand the supply in the economy, then government ‘deficits’ or long-term debt simply reflect the amount of money government has pumped into the system for the private sector to make use of. And presently Government debt as a proportion of GDP is not high by international standards – Japan’s is approximately five times higher!

Keep that in mind, too, when Government bleats that there’s not enough in kitty to give key professions pay rises that barely match inflation (I.e. not in fact a ‘rise’ at all), but there’s a spare couple of billion to buy in defence helicopters that can be shot down by $200 cardboard drones.

Perhaps that what they mean when they talk about “helicopter money”…!

Frank Greenall has been a copywriter, scriptwriter, artist, political cartoonist, adult literacy tutor and administrator, and Whanganui Chronicle columnist for many years, amongst numerous other sundry occupations. His cartoons and articles have appeared in most major NZ newspapers at various times. He has a BA in politics and a Masters in adult literacy/numeracy. https://stevebaron.co.nz/author/frankgreenall/

Steve Baron says:

Good piece, Frank. You’ve nailed how debt has gone from being a simple IOU to this massive industrial complex that’s got its hooks into everyone. Love the “Sixteen Tons” reference—that song still hits hard because not much has really changed, has it?

You’re spot on about the government’s selective poverty, too. Amazing how there’s never enough money for nurses or teachers, but suddenly billions appear for helicopters that’ll probably end up mothballed in a hangar somewhere. The “helicopter money” quip at the end—classic!

I’d just add that while the Reserve Bank can technically print money whenever, it’s not quite the magic pudding we might hope for. Japan’s massive debt hasn’t sunk them yet, true, but they’ve had decades of stagnant growth and their own headaches to deal with.

But yeah, the main point stands—when politicians trot out the “empty cupboard” line while handing out tax breaks to property investors, we’re entitled to call bullshit. The money tree exists; it’s just a question of who gets to pick the fruit.

Enjoyed the read, mate. Always good to see someone calling out the double standards.